The payments ecosystem is highly complex due to the linkage of many different companies that each independently have control mechanisms that affect authorization rates. In a global SaaS subscription business, the potential silent killer of ARR and retention rates is the billing success rate: how many customers are successfully auto-renewed. I call it the Stealthberg KPI, as it is typically among the top five most influential factors affecting revenue, and often the single most sensitive operational factor in the business as a whole, but far too few leadership teams pay close attention to measuring and investing in the control of billing success.

Like the massive ice formation that destroyed the “unsinkable” Titanic, your billing success rate lurks beneath the surface of your metrics dashboard, invisible to most operators, yet capable of sinking even the most promising SaaS business. While you’re focused on optimizing conversion funnels, reducing customer acquisition costs, and tracking monthly recurring revenue, the Stealthberg KPI is quietly causing your most loyal customers into involuntarily churn.

Why Billing Success Rate Is Your Most Critical Hidden Metric

The Foundation of Recurring Revenue

Subscription businesses know all too well the importance of retention to boost expected customer lifetime value and therefore have invested heavily in frictionless signup experiences that put customers’ subscriptions on auto-renewal. That means most recurring revenue and nearly the entire customer base falls into this journey that requires automatic payment to function correctly to smoothly ensure revenue collection.

That’s brilliant when it works, but when it doesn’t work right, what is the first place you look when you see a drop in revenue? Is it the trend of your auto-renewal payment success?

Many SaaS operators can tell you their monthly churn rate to two decimal places, their customer acquisition cost down to the dollar, and their conversion rates across every funnel stage. But ask them their current authorization rate for subscription renewals, and you’ll likely get a blank stare followed by, “I think that’s a payments team thing.”

The Invisible Revenue Leak

Here’s what makes billing failures so insidious: unlike voluntary churn, these customers want to stay subscribed. They have integrated your product into their workflow or lifestyle, they see value in your service, and they have no intention of canceling. Yet a declined payment transforms them from happy, renewing customers into involuntary churn statistics.

Consider the math: if you’re operating at a 90% renewal authorization rate—which many businesses would consider healthy—you’re losing 10% of your renewal revenue not to dissatisfaction or competitive pressure, but to payment processing failures. For a $10M ARR business, that’s $1M in annual revenue walking out the door through no fault of the customer experience, product quality, or market positioning.

The Ecosystem Complexity That Makes Control So Difficult

Payments Isn’t Just a System, it’s an Ecosystem

Like rainforests, there are complex interactions between all the different elements at play. Plants, animals, and insects interact in simple and complex ways, and when one element changes, it can have small or large ripple effects throughout the rest of the ecosystem. Understanding when these changes are affecting everyone or just you is incredibly difficult, as authorization rates are often held quite closely, as if they were a guarded secret.

In my experience leading payments strategy across multiple subscription businesses, I’ve learned that authorization rates fluctuate constantly due to factors completely outside your control:

- Issuing bank policy changes: a bank updates their fraud detection algorithms

- Network-level adjustments: Visa or Mastercard modifies merchant and transaction risk scoring models

- Economic conditions: recession fears trigger more conservative approval patterns or smaller bank account balances

- Seasonal patterns: Holiday spending affects risk thresholds (and also bank account balances)

- Geographic events: Regional regulations or economic instability impact specific markets (it wasn’t long ago that US and EU merchants had to halt sales in Russia essentially overnight due to sanctions)

These complexities also make the overarching strategy for business improvements much more complicated. Not only do you have to account for changes within your own business and customer base, you also have to account for changes in the ecosystem.

During a recent industry discussion on payments experimentation, I noted:

Auth rates are continuously changing due to a variety of reasons. Simply put, the world changes quickly, and not all changes are within your control. It could be the network, the issuers, global economic movements…

At every point in time, you also have a different customer base renewing, so you never face the exact same situation twice.

How the Stealthberg KPI Can Sink Your Ship

The Vicious Downward Cycle

Having such a strong influence on renewal revenue and, by connection, customer lifetime value, billing success has the potential to start a vicious downward cycle that can spiral out of control if not monitored and managed carefully. The adage says that it’s far cheaper to keep a customer than to acquire a new one. Billing success is the path to passively renewing subscribed customers.

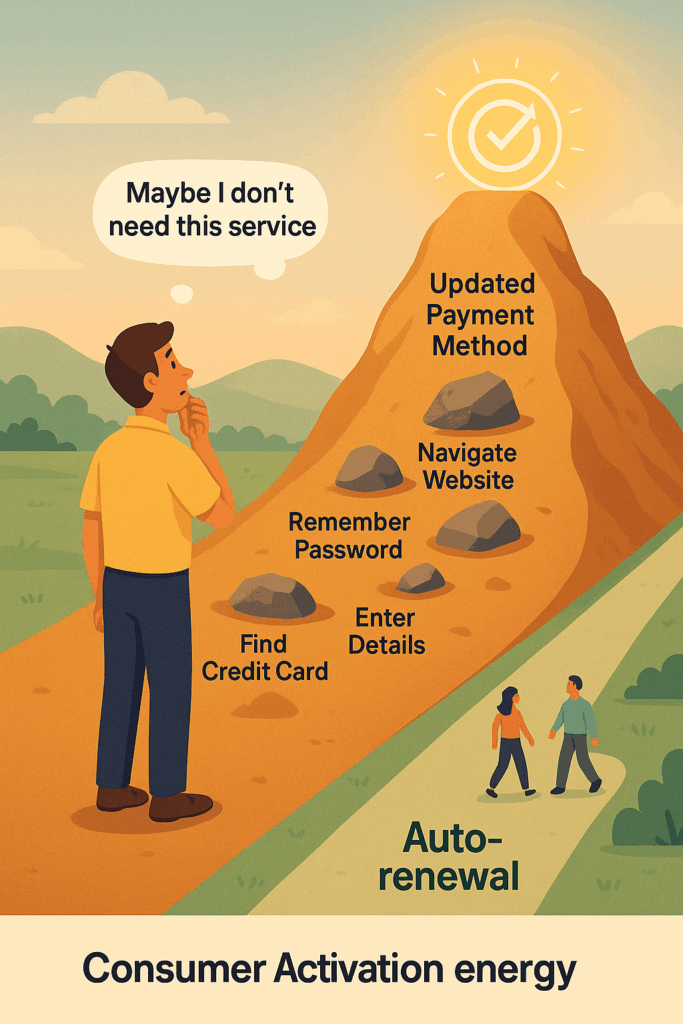

Unless you have a product with very high stickiness (think streaming services where non-payment blocks your ability to watch the next episode of your favorite show), overcoming the “activation energy” to motivate a customer to take action presents a significant challenge.

Here’s how the downard spiral unfolds:

- Payment fails → Customer receives dunning notification

- Customer ignores or misses notification → Service gets suspended after grace period

- Customer experiences service disruption → Frustration builds with your brand

- Manual intervention required → Customer service costs increase

- Customer updates payment → But maybe downgrades or considers alternatives

- Or customer churns entirely → Zero recovery of the residual lifetime value

That’s also why this business model favors the auto-renewal choice architecture from the beginning: it’s better for the business to auto-renew customers and allow them to take action to undo the renewal than to force them to manually renew their subscription every period. It’s also better for the consumer in many cases, as it ensures that there is no interruption of their service.

The Measurement Challenge: Mix vs. Performance

Why Your Auth Rate Moves (Even When Performance Doesn’t Actually Change)

One of the biggest obstacles to managing billing success is understanding whether changes in your authorization rate reflect actual performance improvements or simply shifts in your customer mix.

Mix factors are a major component: your customer base is constantly changing and using different payment methods and card types. Factors like customer tenure, geography, credit cards vs. debit cards vs. other payment methods, and more can cause your overall billing success to move simply because the weighted average changed, not because the performance of any single segment changed.

For example, if your business experiences rapid growth in international markets where authorization rates tend to be lower, your overall billing success rate might decline even if your performance in every individual market improved. Conversely, if you acquire more enterprise customers who predominantly use commercial credit cards (which often, but not always, have higher authorization rates), your metrics might improve without any operational changes.

I learned this lesson firsthand when analyzing what appeared to be declining performance, only to discover through deeper segmentation that our core performance was actually improving; we had simply acquired a larger proportion of customers using payment methods with historically lower authorization rates.

The key is implementing the KPI Prism, a measurement framework that can decompose your KPIs to separate signal from noise, allowing you to identify when changes reflect genuine performance shifts versus natural customer segment evolution. Such a framework also helps measure controlled changes through experimentation to improve billing success.

Building an Experimentation Framework for Payments

The Foundation: Measure and Control

Fundamentally, you can run an experiment anywhere in your business, as long as you can do two things: measure and control. You need to be able to make a change that does something differently, then measure the outcome.

The experimentation principles that drive performance marketing translate extremely well to payments. Both disciplines require understanding how different entities behave and react—whether it’s customers responding to ad creative or banks responding to technical payment parameters.

Establishing Your Baseline

The first step of experimentation is understanding your current state—the baseline against which you’ll measure improvement. When I joined my current role, I honestly didn’t know our baseline, and that’s half the battle. I started by gaining an understanding of what we could measure and control in each tool and system.

Something that is particularly challenging in payments is that some leaders think that payment KPIs will stay flat forever. As described above, billing success rates continuously change due to a variety of factors. When it comes to conducting experiments, you must reassess and re-evaluate your baseline each time. Even better, use A/B testing to have a control baseline to measure against.

Hypothesis Framework: Control Lever + Segment + Outcome

I like to think about experiments in terms of three components:

- A control lever (what you’re changing)

- A customer segment (who you’re testing with)

- An outcome (what you’re measuring)

My mantra is: how can we maximize learning for minimum effort? That’s how you get the most out of experimentation.

For prioritizing experiments, I find the ICE framework most useful:

- Impact: How much could this move the needle?

- Confidence: How sure are we this will work?

- Ease: How difficult is this to implement?

On my team, we crowdsource ratings from 1 to 5 for each factor, multiply them together, and sort our experiment backlog accordingly. Sometimes the simplest approaches are the most effective.

The Control Levers: Your Payment Optimization Toolkit

Internal vs. External Levers

There are both internal and external control levers, and they differ significantly between customer-initiated transactions (CITs) and merchant-initiated transactions (MITs).

For CITs, the customer is involved and engaged, so there’s more the customer can do to make the transaction go through.

For MITs, which include all your subscription renewals, it’s all about getting the bank to feel comfortable enough, statistically speaking, to authorize the transaction.

Multi-Acquirer Routing

One of the most powerful levers is the ability to route failed transactions to different processors. Not all acquirers have the same relationships with issuing banks, and what fails on one processor might succeed on another. This approach requires technical infrastructure to support real-time routing decisions, but the impact can be substantial.

Transaction Timing Optimization

The timing of both initial and retry billing attempts can dramatically affect authorization rates. Time of day, day of week, and day of month all play roles in boosting auth rates among certain segments.

During our experimentation, we discovered fascinating patterns. For instance, we found that certain customer segments in specific geographic regions had significantly higher authorization rates during seemingly random time windows—patterns that only emerged through systematic testing.

One experiment I was initially afraid to try was changing the time of day for our renewal batch job. Our hypothesis was that fraud rules differ throughout the day. After all, is someone really buying something in the middle of the night? While possible, transactions during unusual hours face more scrutiny.

We analyzed authorization rates for customer-initiated transactions by hour to identify peak performance windows, then tested those times for our automated renewals. The results validated our hypothesis and delivered measurable improvement.

Expiry Date Optimization

Account updater services are imperfect. Banks don’t always pass back new card information when cards are replaced, leaving you with outdated payment methods. However, trying different expiry dates in some cases can make a huge difference.

This technique requires careful implementation. Systematic testing of expiry date variations can recover revenue from cards that appear expired but may still be valid.

Network Tokenization

Network tokens issued by the card networks are typically seen as less risky by issuing banks because they represent validated, network-approved payment credentials. However, they’re not fully deployed across every card yet, as many banks have yet to fully enable their entire card portfolio.

When available, network tokens can provide meaningful authorization rate improvements, but adoption requires understanding which customer segments have access to tokenization and building systems to request and utilize these tokens effectively.

Debit Card Network Routing

Similar to multiple acquirers, if you can route debit card transactions across different networks (like PIN vs. signature debit), it can make a significant difference in authorization rates. Different networks have varying relationships with issuing banks and different risk assessment models.

Segmentation Strategy

For all these techniques, testing them with different customer segments can reveal powerful insights. Whether segmenting by business vs. consumer customers, various issuing banks, geographic regions, card types, or other dimensions, you must experiment across different aspects to determine what matters for your specific business.

The Dark Horse: Issuer Outreach

Beyond Technical Solutions

The technique I consider the dark horse in the world of payments optimization requires no technical or logic changes at all. Find the right person at the issuing bank with the ability and authority to adjust fraud rules. You might find authorization rate improvements just by having the bank make a change.

This approach requires relationship building and deep understanding of your transaction patterns, but the potential impact is enormous. When you can demonstrate to an issuing bank that your business represents legitimate recurring revenue with low dispute rates, many banks are willing to adjust their risk parameters for your merchant ID.

The key is presenting compelling data that shows:

- Your historical dispute rates

- Customer tenure and satisfaction metrics

- Transaction pattern consistency

- Geographic and demographic insights about your customer base

- The aligned interests to support your mutual customer

Most payment optimization focuses on what you can control through technology. Issuer outreach recognizes that authorization decisions ultimately happen at the bank level, and sometimes the most effective path to improvement is direct communication rather than technical workarounds.

Creating a Culture of Continuous Improvement

Celebrating Learning, Not Just Wins

One critical aspect of building an effective experimentation program is managing expectations around success rates. If you’re just starting to experiment, you might see a high win rate, but after you’ve implemented several experiments, your success rate will probably approach 10-33% winners. That’s the right balance of risk and reward.

Nobody likes to lose, so as someone leading an experimentation effort, it’s critical to create a culture that celebrates the learning that comes from all experiments. You cannot celebrate only the winners.

As Thomas Edison reportedly said:

I didn’t fail; I found 2,000 ways not to make a light bulb…but I only needed to find one way to make it work.

The more experiments I conduct, the more surprising the results become, both in marketing and payments. It’s often the tests you least suspect that yield the greatest benefit.

Taking Action: Your Stealthberg Assessment

The first step in addressing any hidden threat is bringing it into the light. Most SaaS businesses have sophisticated dashboards tracking dozens of growth and retention metrics, but billing success rate rarely makes the cut.

Conclusion: Navigating Safer Waters

The Stealthberg KPI represents more than just another metric to track. It’s a fundamental shift in how subscription businesses should think about retention and revenue predictability. While your competitors focus on visible threats like pricing pressure and feature differentiation, mastering billing success rate creates an invisible competitive advantage.

Every percentage point improvement in authorization rate flows directly to your bottom line without requiring customer acquisition spend or product development resources. More importantly, it preserves the customer relationships you’ve worked so hard to build, ensuring that payment infrastructure never becomes the reason a satisfied customer churns.

The complexity of the payments ecosystem means this challenge won’t solve itself. But with systematic measurement, thoughtful experimentation, and strategic optimization of the control levers available to you, you can transform the Stealthberg KPI from a hidden threat into a sustainable competitive advantage.

Your customers trust you with their payment information and their continued business. Make sure your payment infrastructure is worthy of that trust.

This post is part of a series on growing global subscription SaaS businesses. Keep in touch for posts that dive deeper into the Fishbone Framework for isolating billing success performance and techniques for measuring mix vs. performance in metrics.

Leave a Reply